Taxes

Federal taxes are taxes imposed by the U.S. national government to fund its operations and constitutional responsibilities. They are authorized by the United States Congress and collected primarily by the Internal Revenue Service. Federal taxes are nationwide and apply uniformly under federal law. They are different from state and local taxes, which are imposed by state governments and municipalities.

What Federal Taxes Pay For

Federal taxes fund nationwide programs and functions, including:

National defense and veterans’ services

Social Security and Medicare

Infrastructure (highways, airports, ports)

Federal courts and law enforcement

Disaster relief and emergency response

Interest on the national debt

Main Types Of Federal Taxes

Individual income tax – on personal earnings

Payroll taxes – Social Security & Medicare (FICA)

Corporate income tax – on business profits

Capital gains tax – on investment profits

Excise taxes – on specific goods (gas, alcohol, tobacco, firearms, airline tickets, etc.)

Estate tax – on large estates after death

Gift tax – on large lifetime gifts

Customs duties (tariffs) – on imported goods

Unemployment taxes (FUTA) – paid by employers

Self-employment tax – effectively payroll taxes for the self-employed (sometimes counted separately)

Tax Rates

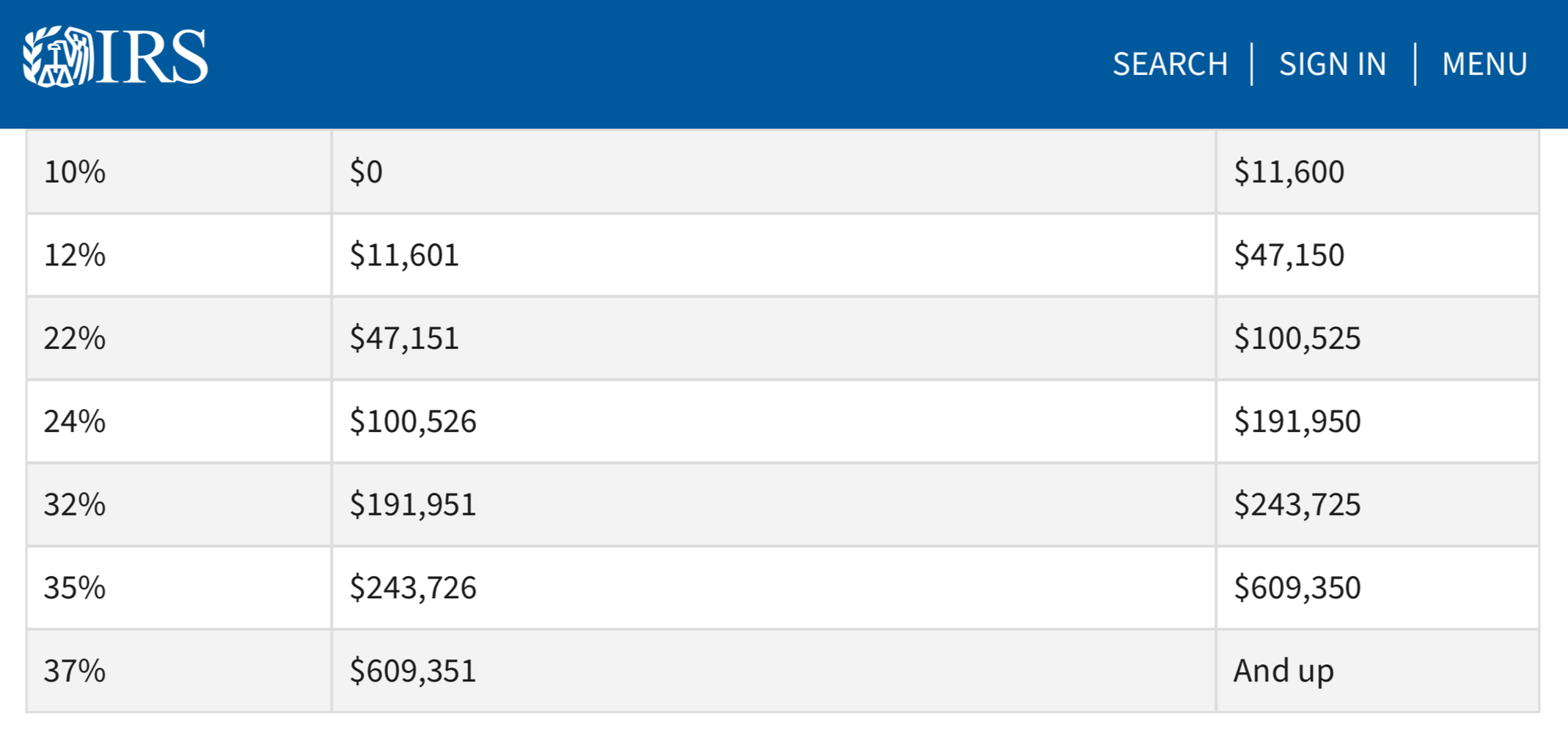

Federal Income Tax Rate (Individual)

In the United States, there is no single federal income tax rate for individuals. Instead, the system uses progressive tax brackets, meaning different portions of your income are taxed at different rates.

Federal income tax is the primary way the U.S. government raises revenue from individuals and businesses based on income earned during a calendar year. It is created by law through the United States Congress and administered and collected by the Internal Revenue Service.

What counts as taxable income

Federal income tax applies to most forms of income, including:

Wages and salaries

Self-employment and business income

Interest and dividends

Capital gains (sale of investments or property)

Rental income

Certain pensions and retirement withdrawals

Some income is excluded or partially excluded, such as certain municipal bond interest or specific benefits.

Progressive tax system

Federal income tax is progressive, meaning:

Income is divided into brackets

Each bracket is taxed at a different marginal rate

Only the income within each bracket is taxed at that bracket’s rate

This is different from a flat tax—earning more does not mean all income is taxed at the highest rate.

Social Security Tax Rate (FICA)

6.2% of wages

Applies only up to the annual wage base limi

Wage Base Limit

Income above the cap is not subject to Social Security tax

The wage base adjusts annually for inflation

Who Pays What

Employees: 6.2% withheld from paychecks

Employers: 6.2% paid separately

Self-employed individuals: 12.4% total (both shares), though part is deductible

Important Clarifications

This is separate from federal income tax

This is not progressive—it’s a flat rate until the cap

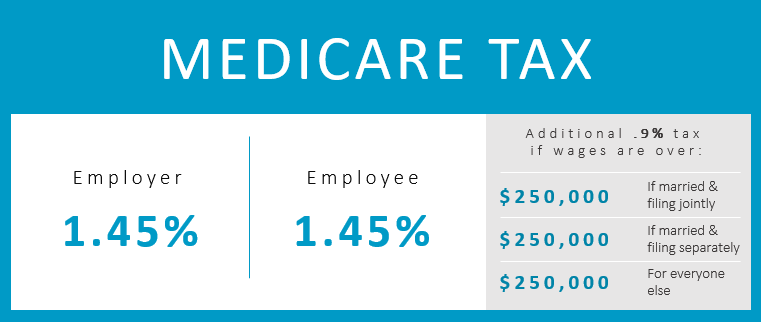

Medicare Tax (FICA)

1.45% of wages

No income cap (unlike Social Security)

Who Pays What

Employees: 1.45% withheld from paychecks

Employers: 1.45% paid separately

Self-employed individuals: 2.9% total, with part deductible

Additional Medicare Tax (High Earners)

On top of the standard rate, higher-income individuals pay an Additional Medicare Tax of 0.9% on wages above:

This 0.9% applies only to the amount above the threshold, not total income.

Employers do not match the additional 0.9%.

Federal Income Tax Rate (Corporate)

The U.S. federal corporate income tax rate is:

21% (flat rate)

This rate has applied since 2018, following the Tax Cuts and Jobs Act of 2017.

Key Characteristics

Flat rate — unlike individual income taxes, there are no brackets

Applies to C-corporations only

Separate from state corporate income taxes, which can add anywhere from 0% to ~12% depending on the state

Important Clarifications

Pass-through entities (LLCs, S-corps, partnerships, sole proprietors) do not pay corporate tax = their income is taxed at individual rates

Many corporations pay an effective rate lower than 21% due to:

Deductions

Credits

Depreciation rules

Loss carryforwards

International tax planning